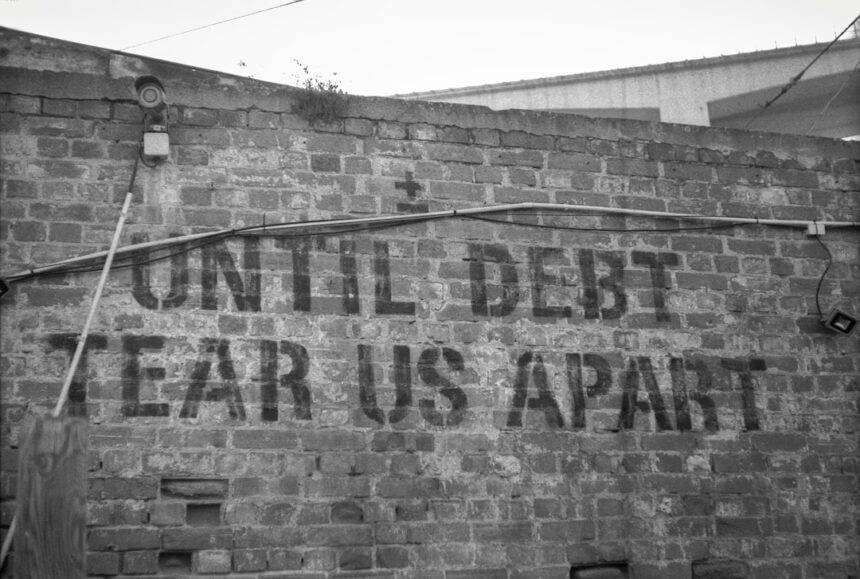

Debt, when unmanaged, can become a relentless current, pulling you under and clouding your financial horizon. It’s not merely a numerical burden; it’s a psychological one, capable of siphoning joy and generating persistent worry. This article aims to equip you with the knowledge and strategies necessary to navigate the complex world of debt, not just to survive, but to thrive, without the suffocating embrace of anxiety.

The Foundations of Financial Security: Building a Solid Base

Before you can effectively address existing debt or prevent future burdens, you must establish a robust foundation for your financial life. This involves understanding where your money is going, creating a roadmap for your spending and saving, and cultivating habits that promote stability. Think of this as building the bedrock of a sturdy house; without it, any structure you attempt to erect is vulnerable to collapse.

Cultivating Financial Awareness: Knowing Your Numbers

The first step in any constructive endeavor is to possess accurate information. When it comes to your finances, this means a clear and honest assessment of your income and expenses.

Tracking Your Income Sources

Identify all the streams of revenue that flow into your household. This includes your primary salary, any freelance work, rental income, or investment returns. Understanding the totality of your incoming resources is the starting point for any effective financial plan.

Categorizing Your Expenses

This is where the real work begins. You need to meticulously track every penny that leaves your wallet. Don’t simply group expenses under broad headings. Dig deeper.

- Fixed Expenses: These are the predictable costs that generally remain the same each month. Examples include mortgage or rent payments, loan repayments (beyond current debt), insurance premiums, and subscription services.

- Variable Expenses: These fluctuate from month to month and offer the most potential for adjustment. Food, utilities, transportation (fuel, public transport), entertainment, and clothing fall into this category.

- Discretionary Spending: This represents the non-essential spending, often the most tempting and the easiest to cut back on. This includes dining out, impulse purchases, hobbies, and vacations.

Utilizing Budgeting Tools

The act of tracking and categorizing can feel overwhelming. Fortunately, numerous tools exist to simplify this process.

- Spreadsheets: For those who prefer a manual approach, spreadsheets offer flexibility and control. You can create custom categories and formulas to suit your specific needs.

- Budgeting Apps: A plethora of mobile applications are designed to automate much of the tracking process. Many link directly to your bank accounts and credit cards, categorizing transactions automatically, though manual adjustments are often necessary.

Establishing a Realistic Budget: Your Financial Compass

Once you have a clear picture of your financial landscape, you can construct a budget. This is not a rigid straitjacket, but rather a dynamic tool that guides your spending and helps you achieve your financial goals.

The Zero-Based Budgeting Method

In this approach, every dollar of your income is allocated a specific purpose. Income minus expenses and savings should equal zero. This ensures that no money is left unassigned, promoting intentionality in your spending.

The 50/30/20 Rule

This is a simpler budgeting guideline where you allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. While less granular than zero-based budgeting, it offers a clear framework for balancing your priorities.

The Envelope System

For tangible control over discretionary spending, the envelope system is effective. Cash is withdrawn for variable and discretionary expenses and placed into designated envelopes. Once an envelope is empty, spending in that category ceases until the next budgeting period.

If you’re looking for effective strategies to manage anxiety related to debt, you might find valuable insights in the article on productive financial habits at Productive Patty. This resource offers practical tips on budgeting and financial planning that can help alleviate the stress associated with debt, ultimately contributing to better mental well-being.

Proactive Debt Prevention: Building Immunity to Financial Illness

Preventing debt is undeniably more advantageous than treating it. It’s akin to inoculating yourself against a highly contagious disease. By implementing proactive strategies, you can significantly reduce your susceptibility to the anxieties that unmanaged debt engenders.

Mindful Credit Card Usage: A Double-Edged Sword

Credit cards can be powerful financial tools when used responsibly, but they can also be a slippery slope into debt. Understanding their intricacies is paramount.

Understanding Interest Rates and Fees

The annual percentage rate (APR) on a credit card dictates the cost of borrowing money. High APRs can quickly inflate your balance, making it difficult to pay down the principal. Be aware of introductory offers, but also of the standard APR that applies once the promotional period ends. Late fees, over-limit fees, and annual fees also contribute to the overall cost of using credit.

The “Pay in Full” Discipline

The most effective way to avoid credit card debt is to treat your credit card as a debit card. At the end of each billing cycle, pay the entire balance in full. This prevents interest charges from accumulating and keeps your debt at bay.

Avoiding “Minimum Payments”

Making only the minimum payment on your credit card is a dangerous practice. A significant portion of your payment goes towards interest, leaving very little to reduce the principal balance. This can trap you in a cycle of debt that takes years, if not decades, to escape.

Responsible Loan Acquisition: Borrowing with Wisdom

Loans, whether for a car, a home, or education, are significant financial commitments. Approaching them with caution and foresight is crucial.

Assessing Your Borrowing Capacity

Before even considering a loan, understand how much you can realistically afford to repay. This involves calculating your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income. Lenders use this as a key indicator of your ability to manage debt.

Shopping for the Best Terms

Do not accept the first loan offer you receive. Shop around with different lenders, compare interest rates, fees, and loan terms. Even a small difference in interest rate can save you thousands of dollars over the life of the loan.

- Fixed-Rate Loans: These offer predictable payments throughout the life of the loan, providing stability and making budgeting easier.

- Variable-Rate Loans: While potentially offering lower initial rates, these loans carry the risk of interest rate increases, which can significantly alter your payment obligations.

Understanding the True Cost of Borrowing

Beyond the advertised interest rate, consider all associated fees. Origination fees, closing costs, and prepayment penalties can add to the overall expense of a loan.

The Power of an Emergency Fund: Your Financial Safety Net

An emergency fund is not a luxury; it is a non-negotiable component of financial security, acting as a buffer against unexpected life events. It’s the financial equivalent of an umbrella on a stormy day.

Defining “Emergencies”

Emergencies are typically defined as unforeseen circumstances that require immediate financial attention and are not part of regular living expenses. Common examples include:

- Job loss or significant reduction in income.

- Unexpected medical expenses or dental bills.

- Urgent home or car repairs.

- Natural disasters or other unforeseen property damage.

Determining the Target Amount

A commonly recommended target for an emergency fund is three to six months of essential living expenses. The exact amount depends on your individual circumstances, including job stability, household dependents, and overall risk tolerance.

Where to Keep Your Emergency Fund

The primary goal of an emergency fund is accessibility. It should be readily available when needed, but also separate from your everyday spending accounts to prevent accidental depletion.

- High-Yield Savings Accounts: These offer a modest return on your savings while keeping your funds liquid and easily accessible.

- Money Market Accounts: Similar to savings accounts, these often offer slightly higher interest rates and may come with check-writing privileges.

Strategizing for Debt Reduction: A Focused Assault on Existing Burdens

If you currently carry debt, the focus shifts from prevention to strategic reduction. This requires a clear plan, discipline, and a willingness to make temporary sacrifices for long-term financial freedom. Think of this as a targeted military campaign to reclaim lost territory.

Understanding Your Debt Landscape: Mapping the Battlefield

Before you can effectively combat your debt, you need a comprehensive understanding of what you owe.

Consolidating Your Debts

Gather all information about your outstanding debts: creditor names, interest rates, minimum payments, and total balances. This comprehensive overview is your battlefield map.

Prioritizing Your Repayment Strategy

There are two primary popular strategies for tackling multiple debts:

- The Debt Snowball Method: This involves paying off your smallest debt first, while making minimum payments on all other debts. Once the smallest debt is paid off, you roll that payment amount into the next smallest debt, creating a snowball effect. The psychological wins of quickly eliminating debts can be highly motivating.

- The Debt Avalanche Method: This method prioritizes paying off debts with the highest interest rates first, while making minimum payments on the others. This approach saves you the most money in interest over time, making it mathematically the most efficient.

Negotiating with Creditors: Seeking Allies in Your Campaign

Sometimes, the most effective strategy involves direct negotiation with your creditors.

Communication is Key

Do not shy away from contacting your creditors if you are struggling to make payments. They are often willing to work with you to find a solution that prevents default.

Exploring Payment Plans and Hardship Programs

Many creditors offer hardship programs or can set up alternative payment plans tailored to your situation. This might include temporarily reducing your interest rate, extending your payment term, or deferring payments.

Debt Consolidation Loans and Balance Transfers

These tools can simplify your debt repayment by combining multiple debts into a single payment.

- Debt Consolidation Loans: You take out a new loan with a potentially lower interest rate to pay off all your existing debts. You then make one monthly payment to the new lender.

- Balance Transfer Credit Cards: These cards offer a low or 0% introductory APR on transferred balances from other credit cards. This can provide a window of opportunity to pay down debt without accruing interest, but be mindful of the regular APR that applies after the promotional period ends.

Cultivating a Debt-Free Mindset: Rewiring Your Financial Thinking

Beyond the practical strategies, fostering a debt-free mindset is fundamental to long-term success. This involves shifting your perspective, developing resilience, and celebrating progress. It’s about building mental fortitude alongside your financial discipline.

Breaking the Cycle of Instant Gratification

Modern society often promotes a culture of instant gratification, where immediate pleasure is prioritized over long-term well-being. Breaking free from this can be challenging but is crucial for debt prevention.

Understanding the Psychological Triggers of Spending

Identify the emotional or situational triggers that lead to impulsive purchases. Are you stressed, bored, or seeking validation? Recognizing these patterns is the first step to interrupting them.

Practicing Delayed Gratification

Consciously delay purchases, especially non-essential ones. Give yourself a cooling-off period of 24 hours or more to assess whether the item is truly something you need or want.

Embracing Financial Minimalism

Financial minimalism is not about deprivation, but about intentionality. It’s about focusing your resources on what truly adds value to your life and letting go of the rest.

Decluttering Your Finances

Just as you might declutter your home, declutter your financial life. This includes:

- Canceling Unused Subscriptions: Review all your recurring payments and cancel those you no longer use or need.

- Reducing Unnecessary Expenses: Analyze your spending for areas where you can cut back without sacrificing essential needs or true enjoyment.

- Simplifying Your Financial Products: If you have multiple bank accounts or investment portfolios, consider consolidating them to make management easier.

Focusing on Value Over Quantity

Shift your focus from acquiring more to appreciating what you have and investing in experiences or items that genuinely enrich your life.

Celebrating Milestones and Progress

The journey to financial freedom can be long, and it’s important to acknowledge and celebrate your achievements along the way.

Setting Achievable Goals

Break down your larger debt repayment goals into smaller, more manageable milestones. This could be paying off a specific credit card, reaching a certain savings target, or eliminating a percentage of your total debt.

Rewarding Yourself (Responsibly)

When you achieve a milestone, treat yourself to a small, non-debt-inducing reward. This could be a nice meal out, a movie, or a new book. The key is to ensure the reward doesn’t negate your progress.

Managing anxiety related to debt can be challenging, but understanding effective prevention strategies can make a significant difference. A helpful resource on this topic can be found in a related article that discusses practical tips for reducing financial stress and maintaining mental well-being. For more insights, you can check out this informative piece on debt prevention, which offers valuable advice to help you navigate your financial concerns with greater ease.

Maintaining Financial Wellness: Sustaining a Debt-Free Lifestyle

Once you have achieved financial stability and reduced your debt, the focus shifts to maintenance. This is about creating sustainable habits that prevent you from falling back into old patterns. It’s about building a robust immune system for your finances.

Continuous Learning and Adaptation

The financial landscape is constantly evolving. Staying informed and adaptable is key to long-term financial wellness.

Staying Informed About Financial Trends

Read reputable financial news, follow experts in the field, and engage in ongoing learning about personal finance. Understanding economic shifts and new financial products can help you make informed decisions.

Adapting Your Financial Plan

Your financial life is not static. As your income, expenses, and life circumstances change, you must adapt your budget and financial plan accordingly. Regular reviews, perhaps quarterly or annually, are essential.

Building a Support System

Share your financial goals and challenges with trusted friends, family members, or a financial advisor. Having a support system can provide encouragement, accountability, and different perspectives.

- Financial Advisors: A qualified financial advisor can offer personalized guidance, help you create a comprehensive financial plan, and provide strategies for managing debt and investing for the future.

- Accountability Partners: Find someone with similar financial goals with whom you can share your progress and challenges. Mutual encouragement can be a powerful motivator.

Embracing a Philosophy of Financial Prudence

Ultimately, preventing anxiety-inducing debt is about cultivating a deep-seated philosophy of financial prudence. This involves a conscious commitment to responsible financial decision-making, a recognition of the long-term consequences of your choices, and a disciplined approach to managing your resources. By understanding the principles outlined in this article and consistently applying them, you can navigate the currents of debt with confidence and build a future of financial peace and security.

▶️ WARNING: Why Your Brain Treats “Future You” Like A Stranger

FAQs

What is anxiety debt prevention?

Anxiety debt prevention refers to strategies and practices aimed at reducing or managing the stress and worry that accumulate over time due to unresolved financial obligations or poor money management. It focuses on proactive steps to avoid the mental burden associated with debt.

How can budgeting help in preventing anxiety related to debt?

Budgeting helps by providing a clear overview of income and expenses, allowing individuals to plan their spending, prioritize debt payments, and avoid overspending. This control reduces uncertainty and financial stress, thereby preventing anxiety.

What role does emergency savings play in anxiety debt prevention?

Having an emergency savings fund acts as a financial safety net for unexpected expenses, reducing the likelihood of incurring new debt. This preparedness helps alleviate anxiety by providing peace of mind that unforeseen costs can be managed without financial strain.

Are there professional resources available for managing debt-related anxiety?

Yes, financial counselors, therapists specializing in financial stress, and debt management programs can provide support and guidance. These professionals help individuals develop coping strategies, create repayment plans, and address the emotional aspects of debt.

Can lifestyle changes contribute to reducing anxiety debt?

Absolutely. Lifestyle changes such as reducing discretionary spending, increasing income through side jobs, and adopting mindful spending habits can improve financial stability. These changes help prevent debt accumulation and the associated anxiety.