Effective pricing requires a comprehensive understanding of your product or service’s value proposition. Value extends beyond production costs and labor inputs to encompass the specific benefits and solutions delivered to customers. This includes measurable improvements to customer operations, problem resolution capabilities, and satisfaction of market needs.

Identifying unique selling propositions (USPs) forms a critical component of value-based pricing strategies. Key differentiators may include product quality metrics, technological innovations, service delivery standards, or integrated feature sets that distinguish offerings from competitive alternatives.

Clear USP identification supports pricing justification through quantifiable value demonstration. This analytical approach serves dual purposes: establishing defensible pricing structures and informing marketing communications. When value propositions are clearly defined and articulated, businesses can effectively communicate benefits to target audiences while maintaining pricing integrity based on demonstrated market value rather than cost-plus methodologies alone.

Key Takeaways

- Understand your product’s value and target the right market for effective pricing.

- Conduct thorough market research and analyze competitors to inform pricing decisions.

- Calculate all costs and desired profit margins to set sustainable prices.

- Test pricing strategies, communicate value clearly, and adjust based on customer feedback.

- Continuously monitor pricing effectiveness and make improvements for long-term success.

Identifying Your Target Market

Once you have a firm grasp of your product’s value, the next step is to identify your target market. This involves defining who your ideal customers are and understanding their demographics, preferences, and purchasing behaviors. You should consider factors such as age, gender, income level, location, and lifestyle choices.

By narrowing down your audience, you can tailor your marketing strategies and pricing to meet their specific needs and expectations. Additionally, understanding your target market allows you to create buyer personas—detailed profiles that represent segments of your audience. These personas help you visualize who you are selling to and what drives their purchasing decisions.

By knowing what motivates your customers, you can adjust your pricing strategy to align with their perceived value of your product or service. This alignment is essential for maximizing sales and ensuring customer satisfaction.

Conducting Market Research

Market research is an indispensable tool in the pricing process. It provides insights into industry trends, consumer behavior, and competitive landscapes. You should gather data through surveys, focus groups, and online research to understand how potential customers perceive your product and its value.

This information will help you gauge what price points are acceptable and competitive within your market. Furthermore, market research allows you to identify gaps in the market that your product can fill. By analyzing customer feedback and preferences, you can uncover opportunities for differentiation that may justify a higher price point.

Understanding the broader market context will enable you to make informed decisions about where to position your product in relation to competitors and how to communicate its value effectively.

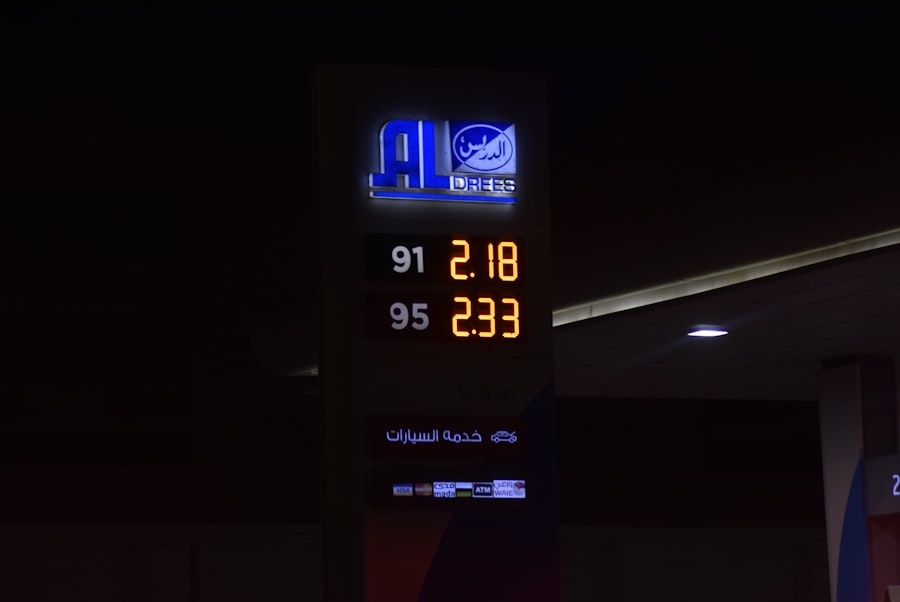

Analyzing Competitor Pricing

A critical aspect of setting your pricing strategy involves analyzing competitor pricing. You need to examine how similar products or services are priced within your industry. This analysis will provide you with a benchmark for establishing your own prices.

However, it’s essential to go beyond just looking at numbers; consider the value propositions of competitors as well. Are they offering additional features or services that justify their pricing? Understanding these dynamics will help you position your offering more strategically.

In addition to direct competitors, consider indirect competition as well. Sometimes, products that serve different needs can still compete for the same budget from consumers. By broadening your analysis to include these alternatives, you can gain a more comprehensive view of the pricing landscape.

This knowledge will empower you to make strategic decisions about whether to price competitively, premiumly, or even below market rates based on the unique value you provide.

Calculating Costs and Expenses

| Pricing Factor | Description | Example Metric | Consideration |

|---|---|---|---|

| Value Delivered | Measure the tangible benefits your service provides to the client. | Percentage increase in revenue or cost savings | Focus on outcomes that matter most to the client’s business goals. |

| Client ROI | Estimate the return on investment your service generates for the client. | ROI ratio (e.g., 3:1) | Price should reflect a fraction of the value created to ensure client satisfaction. |

| Risk Sharing | Align pricing with the risk taken by both parties based on outcomes. | Performance-based fees or bonuses | Incentivizes service provider to deliver results and builds trust. |

| Market Benchmark | Compare pricing with competitors offering similar outcome-based services. | Average price per outcome unit | Ensures competitiveness while maintaining profitability. |

| Complexity of Outcome | Consider how difficult it is to achieve the desired result. | Time or resources required to deliver outcome | Higher complexity justifies higher pricing. |

| Client Size & Budget | Adjust pricing based on the client’s ability to pay and scale of impact. | Client annual revenue or project budget | Ensures pricing is fair and aligned with client expectations. |

| Measurement & Verification | Define how outcomes will be tracked and verified. | Key performance indicators (KPIs) and reporting frequency | Clear metrics reduce disputes and clarify pricing triggers. |

Before finalizing your pricing strategy, it’s crucial to calculate all costs and expenses associated with your product or service. This includes direct costs like materials and labor, as well as indirect costs such as overhead, marketing expenses, and distribution fees. By having a clear understanding of these costs, you can ensure that your pricing covers expenses while still allowing for profitability.

Moreover, calculating costs helps you identify areas where you might reduce expenses without compromising quality. For instance, if you find that certain materials are driving up costs significantly, exploring alternative suppliers or materials could enhance your profit margins. Understanding your cost structure not only informs pricing but also enables you to make strategic business decisions that contribute to long-term sustainability.

Determining Your Desired Profit Margin

Once you have a clear picture of costs and expenses, the next step is determining your desired profit margin. This margin is the difference between the cost of producing your product or service and the price at which you sell it. Establishing a profit margin is essential for ensuring the financial health of your business.

It’s important to set a margin that reflects both industry standards and your business goals. When determining this margin, consider factors such as market demand, competition, and perceived value. A higher profit margin may be achievable if your product offers unique features or benefits that customers are willing to pay for.

Conversely, if you’re entering a highly competitive market with similar offerings, a lower margin might be necessary to attract customers initially. Balancing profitability with competitiveness is key to long-term success.

Establishing Pricing Strategies

With all the foundational work completed—understanding value, identifying target markets, conducting research, analyzing competitors, calculating costs, and determining profit margins—you can now establish effective pricing strategies. There are several approaches you might consider: cost-plus pricing, value-based pricing, penetration pricing, or premium pricing. Each strategy has its advantages and disadvantages depending on your business model and market conditions.

For instance, if you’re launching a new product in a saturated market, penetration pricing might be an effective strategy to attract customers quickly by setting lower initial prices. On the other hand, if you have a unique offering with high perceived value, premium pricing could enhance brand perception and attract customers who associate higher prices with quality. The key is to choose a strategy that aligns with your overall business objectives while remaining flexible enough to adapt as market conditions change.

Testing and Adjusting Pricing

Once you’ve established a pricing strategy, it’s essential to test it in the real world. Implementing A/B testing can be an effective way to gauge customer reactions to different price points or promotional offers. By analyzing sales data and customer feedback during this testing phase, you can determine which pricing strategies resonate best with your audience.

Adjusting pricing based on real-time data is crucial for staying competitive in a dynamic market environment. If certain price points lead to lower sales than expected or if customer feedback indicates that prices are perceived as too high or too low, be prepared to make adjustments accordingly. Flexibility in pricing allows you to respond quickly to market changes and customer preferences.

Communicating Value to Customers

Effective communication of value is vital in justifying your pricing strategy to customers. You need to articulate not just what your product or service does but also how it benefits users in tangible ways. This involves crafting compelling marketing messages that highlight the unique features and advantages of your offering.

Customer testimonials and case studies can also serve as powerful tools in demonstrating value. When potential buyers see real-life examples of how others have benefited from your product or service, they are more likely to perceive its worth and feel justified in paying the price you’ve set.

Monitoring and Evaluating Pricing Effectiveness

After implementing your pricing strategy and communicating value effectively, ongoing monitoring is essential for evaluating its effectiveness. Regularly review sales data and customer feedback to assess whether your pricing aligns with market expectations and business goals. Key performance indicators (KPIs) such as sales volume, revenue growth, and customer acquisition costs can provide valuable insights into how well your pricing strategy is performing.

Additionally, keep an eye on external factors such as economic conditions or shifts in consumer behavior that may impact pricing effectiveness. Being proactive in monitoring these elements allows you to make informed decisions about potential adjustments needed in response to changing circumstances.

Seeking Feedback and Making Continuous Improvements

Finally, seeking feedback from customers is crucial for continuous improvement in both product offerings and pricing strategies. Encourage open communication through surveys or direct outreach to understand how customers perceive value and pricing fairness. This feedback loop not only helps refine your approach but also fosters customer loyalty by demonstrating that you value their opinions.

Incorporating feedback into your business practices creates a culture of continuous improvement that can lead to enhanced customer satisfaction and increased sales over time. By remaining adaptable and responsive to customer needs and market changes, you position yourself for long-term success in an ever-evolving marketplace. In conclusion, navigating the complexities of pricing requires a multifaceted approach that encompasses understanding value, identifying target markets, conducting thorough research, analyzing competitors, calculating costs accurately, determining profit margins wisely, establishing effective strategies, testing rigorously, communicating clearly with customers, monitoring performance diligently, and seeking feedback consistently for improvement.

By following these steps diligently, you can create a robust pricing framework that not only drives profitability but also fosters lasting relationships with customers.

When considering how to price your services based on outcomes, it’s essential to understand the value you provide to your clients. A helpful resource on this topic can be found in the article on Productive Patty, which discusses various strategies for outcome-based pricing. You can read more about it [here](https://www.productivepatty.com/). This article offers insights that can help you align your pricing with the results you deliver, ensuring that both you and your clients benefit from a fair and effective pricing model.

FAQs

What does pricing services based on outcomes mean?

Pricing services based on outcomes means setting your fees according to the results or value your service delivers to the client, rather than charging by the hour or a fixed rate.

Why should I price my services based on outcomes?

Pricing based on outcomes aligns your incentives with the client’s success, can increase client satisfaction, and often allows you to charge premium rates because you are demonstrating clear value.

How do I determine the right price for outcome-based services?

To determine the right price, assess the value your service provides to the client, consider the potential financial impact of the outcomes, analyze market rates, and factor in your costs and desired profit margin.

What types of services are best suited for outcome-based pricing?

Services with measurable results, such as consulting, marketing, coaching, or project-based work, are well-suited for outcome-based pricing because the impact can be clearly quantified.

How can I measure outcomes effectively?

Define clear, specific, and measurable goals with your client upfront, use key performance indicators (KPIs), and track progress regularly to ensure outcomes are objectively assessed.

What are the risks of pricing based on outcomes?

Risks include difficulty in measuring outcomes, external factors affecting results beyond your control, and potential disputes over whether outcomes were achieved.

How can I mitigate risks when pricing based on outcomes?

Mitigate risks by setting clear expectations, defining measurable outcomes, including clauses for uncontrollable factors, and possibly combining outcome-based pricing with a base fee.

Is outcome-based pricing suitable for all industries?

No, outcome-based pricing is more suitable for industries where results can be clearly defined and measured. It may not be practical for services with intangible or long-term outcomes.

How do I communicate outcome-based pricing to clients?

Explain the benefits, clarify how outcomes will be measured, outline the pricing structure transparently, and provide examples or case studies to build trust.

Can outcome-based pricing increase my revenue?

Yes, if implemented correctly, outcome-based pricing can increase revenue by demonstrating value, attracting clients willing to pay for results, and differentiating your services from competitors.