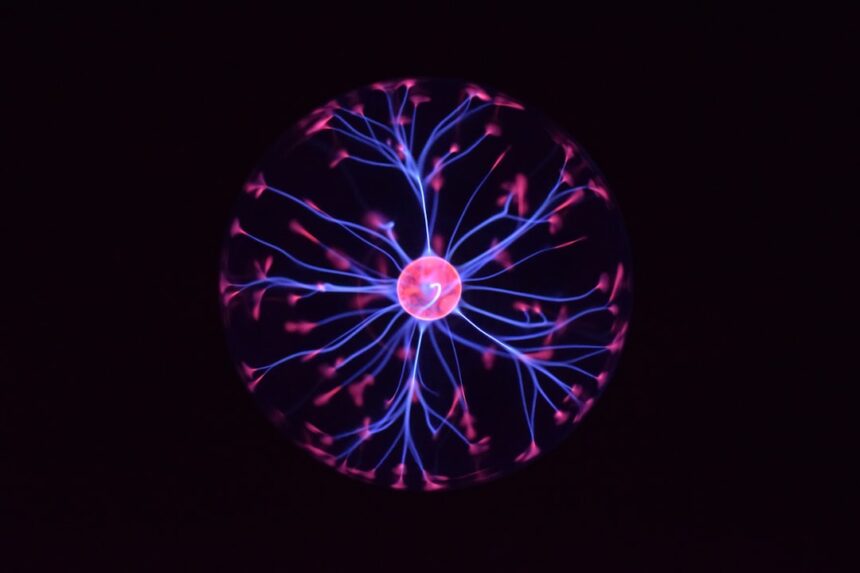

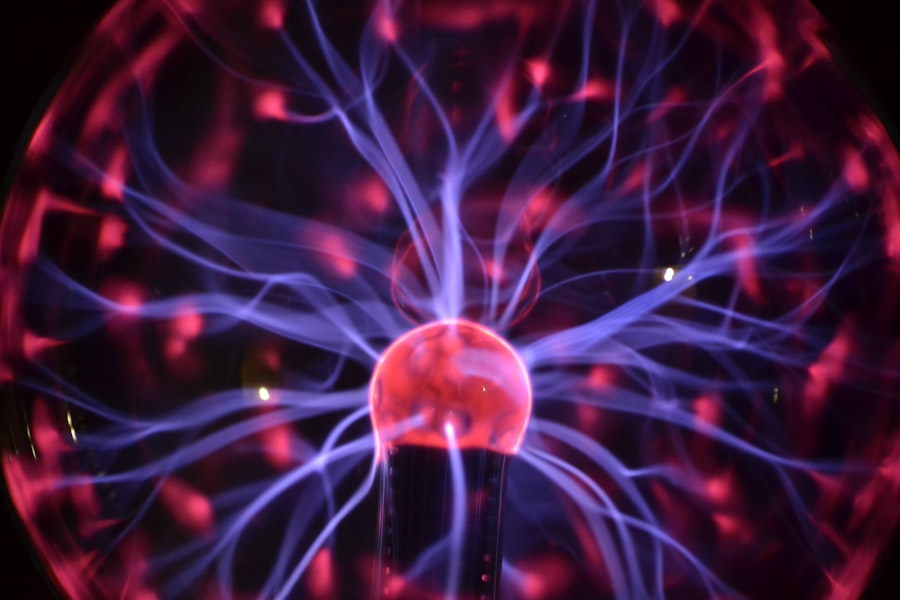

To navigate the complexities of money conversations, it is essential to first grasp the intricacies of the nervous system. Your nervous system is a complex network that governs your body’s responses to various stimuli, including emotional and financial stressors. It comprises two main components: the central nervous system, which includes the brain and spinal cord, and the peripheral nervous system, which connects the brain and spinal cord to the rest of your body.

Understanding how these systems interact can provide you with valuable insights into your reactions during discussions about money.

This reaction is rooted in your biology and can lead to heightened anxiety or defensiveness.

Recognizing this physiological response is crucial; it allows you to take a step back and assess your feelings rather than react impulsively. By understanding how your nervous system operates, you can better manage your emotions and responses, leading to more productive discussions about finances.

Key Takeaways

- Understanding and regulating the nervous system is key to managing stress in money conversations.

- Recognizing personal triggers helps prevent emotional reactions during financial discussions.

- Building resilience and creating safe spaces foster open and constructive money conversations.

- Empathy and mindful communication improve connection and reduce conflict around money topics.

- Setting boundaries and addressing power dynamics ensure respectful and balanced financial dialogues.

Recognizing Triggers in Money Conversations

Identifying your triggers during money conversations is a vital step toward fostering healthier dialogues. Triggers can be anything from specific phrases or topics that evoke strong emotions to past experiences that resurface during discussions.

By recognizing these triggers, you can prepare yourself to respond more thoughtfully rather than reactively. Moreover, it’s not just your triggers that matter; understanding the triggers of those you are conversing with is equally important. When you engage in a money conversation, pay attention to the other person’s body language and emotional cues.

Are they becoming tense or withdrawn? These signs can indicate that they are experiencing their own triggers. By being aware of both your triggers and those of others, you can create a more empathetic and constructive environment for discussing financial matters.

Techniques for Regulating the Nervous System

Once you have identified your triggers, the next step is to learn techniques for regulating your nervous system during money conversations. One effective method is deep breathing. When you feel your heart racing or your palms sweating, take a moment to focus on your breath.

Inhale deeply through your nose, allowing your abdomen to expand, and then exhale slowly through your mouth. This simple practice can help calm your nervous system and bring clarity to your thoughts. Another technique involves grounding exercises.

These exercises help anchor you in the present moment, reducing anxiety and promoting a sense of safety. You might try focusing on the sensations in your feet as they connect with the ground or observing the details of your surroundings. By grounding yourself, you can create a mental space that allows for more rational thinking and less emotional reactivity during financial discussions.

Building Resilience in Money Conversations

Building resilience in money conversations is about developing the ability to bounce back from difficult discussions and learn from them. One way to cultivate resilience is by reframing your mindset around money. Instead of viewing financial discussions as confrontational or stressful, try to see them as opportunities for growth and understanding.

This shift in perspective can empower you to approach conversations with curiosity rather than fear. Additionally, practice self-compassion during these discussions. It’s natural to feel vulnerable when discussing finances, but being kind to yourself can help mitigate feelings of shame or inadequacy.

Acknowledge that everyone has their own financial struggles and that it’s okay to make mistakes or feel uncomfortable. By fostering resilience through a positive mindset and self-compassion, you can engage in money conversations with greater confidence and openness.

Creating Safe Spaces for Money Conversations

| Metric | Description | Recommended Practice | Impact on Conversation |

|---|---|---|---|

| Heart Rate Variability (HRV) | Measure of nervous system flexibility and stress response | Practice deep breathing before and during money talks | Improves calmness and clarity in discussions |

| Breathing Rate | Number of breaths per minute, indicator of stress | Slow, controlled breathing to reduce anxiety | Reduces tension and promotes open communication |

| Body Posture | Physical stance reflecting nervous system state | Maintain open, relaxed posture | Encourages trust and receptivity |

| Eye Contact Duration | Length of sustained eye contact during conversation | Balanced eye contact to show engagement without intimidation | Builds connection and understanding |

| Speech Pace | Speed of speaking, influenced by nervous system arousal | Speak slowly and clearly | Enhances comprehension and reduces misunderstandings |

| Emotional Awareness | Recognition of own and others’ emotional states | Pause to identify feelings before responding | Facilitates empathy and constructive dialogue |

Creating a safe space for money conversations is essential for fostering open dialogue and mutual understanding. A safe space allows both parties to express their thoughts and feelings without fear of judgment or retaliation. To establish this environment, start by setting clear intentions for the conversation.

Communicate that the goal is to understand each other better rather than to assign blame or criticize. Additionally, consider the physical setting of your conversation. Choose a comfortable and private location where both parties feel at ease.

This could be a quiet room in your home or a cozy café where you can talk without distractions. The atmosphere plays a significant role in how comfortable individuals feel discussing sensitive topics like finances. By prioritizing safety and comfort, you lay the groundwork for more productive and meaningful money conversations.

The Role of Empathy in Money Conversations

Empathy is a powerful tool in any conversation, but it holds particular significance in discussions about money. When you approach these conversations with empathy, you demonstrate an understanding of the other person’s feelings and experiences related to finances. This can help bridge gaps in communication and foster a sense of connection between both parties.

To practice empathy effectively, actively listen to what the other person is saying without interrupting or formulating your response while they speak. Reflect on their feelings by acknowledging their concerns and validating their experiences. For example, if someone expresses anxiety about their financial situation, respond with understanding rather than dismissing their feelings.

By cultivating empathy in money conversations, you create an atmosphere of trust that encourages open dialogue and collaboration.

Setting Boundaries in Money Conversations

Setting boundaries is crucial for maintaining healthy dynamics during money conversations. Boundaries help define what is acceptable behavior and what is not, allowing both parties to feel respected and heard. Start by communicating your boundaries clearly before entering into a financial discussion.

For instance, you might express that certain topics are off-limits or that you need breaks if the conversation becomes too intense. It’s also important to respect the boundaries set by others. If someone indicates that they are uncomfortable discussing specific financial matters, honor their request without pushing further.

Establishing mutual boundaries creates a sense of safety and respect, enabling both parties to engage more openly in discussions about money.

Practicing Mindfulness in Money Conversations

Mindfulness is an invaluable practice that can enhance your ability to engage in money conversations effectively. By being present in the moment, you can better manage your emotions and reactions during discussions about finances. Start by incorporating mindfulness techniques into your daily routine; this could involve meditation, journaling, or simply taking time to reflect on your thoughts and feelings regarding money.

During money conversations, practice active mindfulness by focusing on the present moment rather than getting lost in worries about the past or future. Pay attention to your thoughts, emotions, and physical sensations as they arise during the discussion. This awareness allows you to respond thoughtfully rather than react impulsively, leading to more constructive outcomes in financial dialogues.

Using Body Language to Enhance Money Conversations

Body language plays a significant role in communication, especially during sensitive discussions like those about money. Your nonverbal cues can convey emotions and intentions just as powerfully as words do. To enhance your money conversations, be mindful of your body language; maintain an open posture, make eye contact, and use gestures that express engagement and understanding.

Additionally, pay attention to the body language of others during these conversations. Are they leaning away from you or crossing their arms? These signals may indicate discomfort or defensiveness.

By being attuned to both your own body language and that of others, you can create a more inviting atmosphere for open dialogue about finances.

Addressing Power Dynamics in Money Conversations

Power dynamics often play a significant role in money conversations, influencing how individuals communicate and interact with one another. Recognizing these dynamics is essential for fostering equitable discussions about finances. For instance, if one person holds more financial knowledge or resources than the other, it can create an imbalance that affects communication.

To address power dynamics effectively, strive for transparency in your conversations about money. Share information openly and encourage questions from all parties involved. This approach helps level the playing field and fosters an environment where everyone feels empowered to contribute their perspectives without fear of judgment or dismissal.

Applying the Nervous System Playbook in Real-Life Scenarios

Finally, applying what you’ve learned about the nervous system and its impact on money conversations can lead to transformative changes in how you approach these discussions in real life. Start by practicing self-awareness before entering into any financial dialogue; check in with yourself about how you’re feeling emotionally and physically. As you engage in conversations about money, utilize techniques such as deep breathing or grounding exercises if you notice signs of anxiety or stress arising.

Remember to create safe spaces for dialogue by setting clear intentions and respecting boundaries while practicing empathy throughout the conversation. By integrating these strategies into your real-life interactions surrounding finances, you’ll not only improve your own experience but also contribute positively to those around you—ultimately fostering healthier relationships with money for everyone involved.

In exploring effective strategies for navigating money conversations, the article on the nervous system playbook offers valuable insights into how our physiological responses can impact financial discussions. For further reading on related topics, you might find this article on [Productive Patty](https://www.productivepatty.com/sample-page/) particularly helpful, as it delves into practical techniques for enhancing communication and reducing anxiety during financial talks.

FAQs

What is the nervous system playbook for money conversations?

The nervous system playbook for money conversations is a set of strategies and techniques designed to help individuals manage their physiological and emotional responses during discussions about money. It focuses on understanding how the nervous system reacts to financial stress and provides tools to stay calm, clear, and effective in money-related conversations.

Why is the nervous system important in money conversations?

The nervous system regulates our stress and emotional responses. During money conversations, it can trigger anxiety, fear, or defensiveness, which may hinder clear communication. Understanding and managing the nervous system helps individuals stay grounded, reduce stress, and engage in more productive and empathetic financial discussions.

What are common nervous system responses during money conversations?

Common responses include increased heart rate, shallow breathing, muscle tension, and heightened emotional reactions such as anxiety or anger. These are part of the body’s fight, flight, or freeze response to perceived threats, which can occur during stressful money talks.

How can I prepare my nervous system before a money conversation?

Preparation techniques include deep breathing exercises, mindfulness practices, grounding techniques, and setting clear intentions for the conversation. These methods help calm the nervous system, increase self-awareness, and promote a more balanced emotional state before engaging in financial discussions.

What strategies can help regulate the nervous system during money conversations?

Strategies include paced breathing, taking short breaks if emotions escalate, active listening, maintaining a calm tone, and using positive self-talk. These approaches help prevent overwhelm and keep the conversation constructive.

Can understanding the nervous system improve financial decision-making?

Yes, by managing nervous system responses, individuals can reduce emotional reactivity and think more clearly, leading to better financial decisions and healthier money relationships.

Is the nervous system playbook useful for all types of money conversations?

Yes, it is beneficial for a wide range of money conversations, including discussions with partners, family members, financial advisors, or colleagues, especially when the topics are sensitive or potentially stressful.

Where can I learn more about the nervous system playbook for money conversations?

Resources include books on financial psychology, workshops on money mindset, courses on emotional regulation, and articles by experts in financial therapy and nervous system regulation. Consulting a financial therapist or coach trained in these areas can also be helpful.